Security Center

The safety and confidentiality of financial information is always a priority for those with responsibility for management of personal, business and government funds. At UniBank, we are dedicated to the protection of our customers’ information. From internal security, like firewalls and state-of-the-art encryption methods, to security procedures that verify wire transmittals and protect your e-mail communications with us, we continually test and update all of our systems and procedures. You can have confidence that UniBank is dedicated to the protection of your valuable information.

UniBank will never ask you to verify personal information via email, we already have your information on file. If you have responded to a suspicious unsolicited email with personal information, contact UniBank immediately at 800.578.4270.

Report Fraud & Scams

If your suspect your UniBank accounts have been impacted by fraud, contact UniBank immediately at 800.578.4270.

Identity Theft

Signs of Identity Theft

(Source: Federal Trade Commission Consumer Information)

Once identity thieves have your personal information, they can drain your bank account, run up charges on your credit cards, open new utility accounts, or get medical treatment on your health insurance.

If you suspect that someone is misusing your personal information, acting quickly is the best way to limit the damage. Setting things straight involves some work.

How Do Thieves Get Your Information?

"I thought I kept my personal information to myself." You may have, but identity thieves are resourceful: they rummage through your garbage, the trash of businesses, or public dumps. They may work — or pretend to work — for legitimate companies, medical offices, clinics, pharmacies, or government agencies, or convince you to reveal personal information. Some thieves pretend to represent an institution you trust, and try to trick you into revealing personal information by email or phone.

What Do Thieves Do With Your Information?

Once identity thieves have your personal information, they can drain your bank account, run up charges on your credit cards, open new utility accounts, or get medical treatment on your health insurance. An identity thief can file a tax refund in your name and get your refund. In some extreme cases, a thief might even give your name to the police during an arrest.

Clues That Someone Has Stolen Your Information

- You see withdrawals from your bank account that you can't explain.

- You don't get your bills or other mail.

- Merchants refuse your checks.

- Debt collectors call you about debts that aren't yours.

- You find unfamiliar accounts or charges on your credit report.

- Medical providers bill you for services you didn't use.

- Your health plan rejects your legitimate medical claim because the records show you've reached your benefits limit.

- A health plan won't cover you because your medical records show a condition you don't have.

- The IRS notifies you that more than one tax return were filed in your name, or that you have income from an employer you don't work for.

- You get notice that your information was compromised by a data breach at a company where you do business or have an account.

What If Your Information is Lost or Stolen, But Your Accounts Don't Show Any Problems?

If your wallet, Social Security card, or other personal, financial or account information are lost or stolen, contact the credit reporting companies and place a fraud alert on your credit file. Check your bank and other account statements for unusual activity. Order a free copy of your credit report periodically to monitor your accounts. You have a right to one free copy of your credit report from each of the national credit reporting companies every year. If you stagger your orders, you can get a credit report every four months.

Your state law controls the rights you have if your information is lost in a data breach. When the organization that lost your information lets you know about the breach, they should explain your options.

Cybersecurity

A Cyber Security Checklist

(Source: FDIC Consumer News)

Reminders about 10 simple things bank customers can do to help protect their computers and their money from online criminals

- Have computer security programs running and regularly updated to look for the latest threats. Install anti-virus software to protect against malware (malicious software) that can steal information such as account numbers and passwords, and use a firewall to prevent unauthorized access to your computer.

- Be smart about where and how you connect to the Internet for banking or other communications involving sensitive personal information. Public Wi-Fi networks and computers at places such as libraries or hotel business centers can be risky if they don't have up-to-date security software.

- Get to know standard Internet safety features. For example, when banking or shopping online, look for a padlock symbol on a page (that means it is secure) and "https://" at the beginning of the Web address (signifying that the website is authentic and encrypts data during transmission).

- Ignore unsolicited emails asking you to open an attachment or click on a link if you're not sure it's who truly sent it and why. Cybercriminals are good at creating fake emails that look legitimate, but can install malware. Your best bet is to either ignore unsolicited requests to open attachments or files or to independently verify that the supposed source actually sent the email to you by making contact using a published email address or telephone number.

- Be suspicious if someone contacts you unexpectedly online and asks for your personal information. A safe strategy is to ignore unsolicited requests for information, no matter how legitimate they appear, especially if they ask for information such as a Social Security number, bank account numbers and passwords.

- Use the most secure process you can when logging into financial accounts. Create "strong" passwords that are hard to guess, change them regularly, and try not to use the same passwords or PINs (personal identification numbers) for several accounts.

- Be discreet when using social networking sites. Criminals comb those sites looking for information such as someone's place of birth, mother's maiden name or a pet's name, in case those details can help them guess or reset passwords for online accounts.

- Be careful when using smartphones and tablets. Don't leave your mobile device unattended and use a device password or other method to control access if it's stolen or lost.

- Parents and caregivers should include children in their cybersecurity planning. Talk with your child about being safe online, including the risks of sharing personal information with people they don't know, and make sure the devices they use to connect to the Internet have up-to-date security.

- Small business owners should have policies and training for their employees on topics similar to those provided in this checklist for customers, plus other issues that are specific to the business. For example, consider requiring more information beyond a password to gain access to your business's network, and additional safety measures, such as requiring confirmation calls with your financial institution before certain electronic transfers are authorized.

Elder Fraud

Fraud Against the Elderly:

How You Can Spot and Prevent Financial Abuse

(Source: FDIC Consumer Information)

Each year millions of senior citizens are victimized by financial fraud or theft of money, property or valuable personal information. Often, an adult child or other relative is responsible. Other situations may involve trusted individuals such as caregivers, legal guardians, investment advisors or new "friends." And because the types of abuse may differ widely, it's important to take a variety of precautions. Here are suggestions for protecting yourself and your loved ones:

Choose an advisor carefully. If you're considering hiring a new broker, attorney, accountant or other professional, even someone recommended by a friend or relative, it's best to independently look into that person's background and reputation before investing money or paying for services. For example, you can confirm that this person is properly registered or licensed and has a clean record with regulators and other consumers. When in doubt about how to research this information, ask your state Attorney General's office or local consumer protection agency for guidance.

Make sure you not only understand the role an advisor will be playing, but trust that this individual will do what's best for you and your finances. Don't be afraid to ask questions or say no. After all, it's your money!

Be careful with powers of attorney. At some point, you may want to have a power of attorney, a legal document that authorizes another person to transact business on your behalf. While powers of attorney can be very helpful, be careful who you name as your representative. "Powers of attorney can be easily misused because they allow the appointed person to step into your shoes and do everything you can do, including taking money from your account and borrowing money in your name," warned Debi Hodes, an FDIC Consumer Affairs Specialist. "This is a matter to discuss with a lawyer who should prepare or review the document for you."

Protect your personal financial information. Never give out your bank account numbers, Social Security numbers, PINs (personal identification numbers), passwords or other sensitive information unless you initiate the contact. These requests may come from an unsolicited phone caller, letter writer, e-mailer or a person who shows up at your door. Be especially wary of someone who congratulates you about winning a (bogus) prize or lottery but first demands payment for taxes or other fees.

Also, keep your checkbook, account statements, and other sensitive information in a safe place. And shred paper documents containing sensitive information that is no longer needed.

Closely monitor your credit card and bank account activity. Review your account statements as soon as you receive them and look for unauthorized or suspicious transactions, which should be reported to your bank immediately.

Take your time when deciding on a major financial decision or investment. Make sure you understand the transaction and ask questions if you don't. If you need to, ask a lawyer or financial advisor to help you understand the documents and discuss what's best for you. "Walk away from anyone who says you must make a decision or otherwise do something right now," said Hodes.

Be aware of scams involving reverse mortgages. These loans enable homeowners age 62 or older to borrow money from the equity in their homes. However, reverse mortgages can be complex products with a variety of risks and costs, and there are many reports of schemes by unscrupulous individuals using deceptive offers and high-pressure tactics to steer senior citizens into using the funds from a reverse mortgage for inappropriate or costly loans or investments. For guidance on the responsible use of a reverse mortgage, including how to locate a lender or a housing counselor approved by the U.S. Department of Housing and Urban Development's Federal Housing Administration, start here or call 1-800-569-4287.

Finally, here are additional tips:

- Beware of callers asking for money or information. If you'd like to reduce the number of telemarketing calls you receive, consider signing up for the national Do Not Call Registry (call 1-888-382-1222 or visit www.donotcall.gov). If you are on this list, be suspicious of calls from any company or organization that you have reason to believe is not eligible to contact you under the registry's rules.

- Don't comply with requests from strangers to deposit a check into your account (perhaps as part of an Internet sale) and wire some or all of it back. "If you send the money and the check is counterfeit, you may be held responsible by your financial institution for the losses," said Michael Benardo, Chief of the FDIC's Cyber-Fraud and Financial Crimes Section.

- If you use social media, many security experts advise against posting the names of relatives and anyone's home address, full date of birth and daily activities because those can be valuable to a thief. "A scam on the rise involves con artists who look for personal information on the Internet that they can use to call or e-mail an elderly person and pretend to be a relative in distress — such as a grandchild being injured, in jail or lost in a foreign country — and needing money sent fast, without telling anyone else in the family," added Benardo. "They may also represent themselves as a lawyer or law enforcement agent needing money to help your relative."

OUCH! Newsletters

The OUCH! Newsletter is provided by the SANS Institute:

Passkeys - A Simpler and Safer Way to Sign In (September 2025)

Spotting Online Job Scams (August 2025)

Protecting Our Seniors from Scams (July 2025)

Defending Against Malware: The Invisible Enemy (June 2025)

How Cybercriminals Exploit Your Emotions (May 2025)

Account Takeovers: Emotional Predators (April 2025)

Beware of Deepfakes: A New Age of Deception (March 2025)

Sweet Talk and Empty Wallet: Romance Fueled Investment Scams (February 2025)

Smart Home Devices: Lock Them Down Before Cyber Criminals Do (January 2025)

Unveiling the Shadows: How Cyber Criminals Steal Your Passwords (December 2024)

E-ZPass Smishing Scam

What is the E-ZPass Smishing Scam?

Recently, scammers have been targeting consumers with a "smishing" scam where they send a text or email claiming to be from the E-ZPass tolling agency. They claim that a driver has an unpaid toll and they need to settle their bill using a link provided in the message before late fees are incurred.

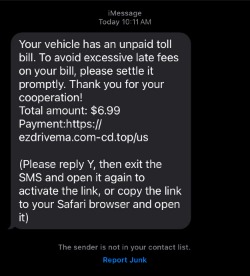

Sample text message:

UniBank urges you to NEVER click on links from unknown senders, in both text messages and emails.

What should you do if you have received a suspicious text or email?

If you have received a text message or email about an outstanding bill and are unsure if it is legitimate or a scam, there are a few precautions you can take:

What should you do if you have received a suspicious text or email?

If you have received a text message or email about an outstanding bill and are unsure if it is legitimate or a scam, there are a few precautions you can take:

- Do. Not. Respond. The scam mail is likely seeking personal and/or financial information.

- If you are concerned about an unpaid bill, you should contact E-ZPass directly to verify any possible charges. Do not use the contact information on the suspected scam message. You can visit their website or contact them via telephone at 877-627-7745.

- You can also report suspected internet crimes to the FBI at www.ic3.gov.

If you have already clicked on a link and suspect fraud on your UniBank account, please contact us at customer.service@unibank.com or call us at 800.578.4270.

If you suspect fraud on an account you hold at another financial institution, contact that financial institution immediately.

If you suspect fraud on an account you hold at another financial institution, contact that financial institution immediately.

Home Warranty Mail Scams

What Are Home Warranty Mail Scams?

Home Warranty mail scams are deceptive mortgage communications that warn consumers their "home warranty may be expiring or may have already expired". These mailings ask for payment, or for the consumer to contact the mailer and may include UniBank's name to seem legitimate. The name of your mortgage lender is public record, UniBank will never call or send you anything relating to home warranties.

Red Flags to look out for

- Threatening language or unnecessary urgency.

- Missing specific details about the government entity the mail claims to be from.

- Information that does not match your current circumstances.

- Requests payment by phone to activate or renew home warranty coverage.

What should you do if you have received a home warranty mail scam?

If you have received mail about a home warranty and are unsure if it is legit or a scam, there are a few precautions you can take.

- Do. Not. Respond. The scam mail is likely seeking personal information.

- Report suspected mail fraud to the U.S. Postal Inspection Services.

- Contact your mortgage lender directly, do not use the contact information on the suspected scam mail.

- Shred any mail that contains personal information and disregard and dispose of the letter.

How can you stop receiving home warranty mail?

The best way to stop receiving home warranty scam mail is to opt out of unsolicited communication from major credit bureaus by:

- Completing the form online at OptOutPrescreen.com

- Calling 1.888.5.OPT.OUT (1.888.567.8688)

If you have received mail regarding home warranty and have questions, or feel you are being pressured to make a payment, please contact us at customer.service@unibank.com or call us at 800.578.4270.

ClickFix Scams

What Are ClickFix Scams?

A new malware deployment scheme has gone mainstream dubbed "ClickFix". In this scam, visitors to a hacked or malicious website are asked to distinguish themselves from bots by pressing a combination of keyboard keys that causes Microsoft Windows to download password-stealing malware.

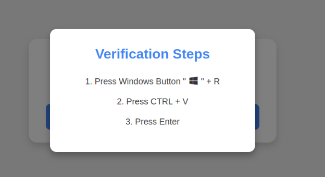

Here's how the scam works:

Step 1 involves simultaneously pressing the keyboard key with the

Windows icon and the letter "R," which opens a Windows "Run" prompt that will execute any specified program that is already installed on the system.

Step 2 asks the user to press the "CTRL" key and the letter "V" at the same time, which pastes malicious code from the site's virtual

clipboard.

Step 3 — pressing the "Enter" key — causes Windows to download and launch malicious code.

To protect yourself from one of these attacks, keep an eye out for any verifications that require you to press the Windows key and the "R" key simultaneously.

If you have already executed a command from a website verification and suspect fraud on your UniBank account, please contact us at customer.service@unibank.com or call us at 800.578.4270.

If you suspect fraud on an account you hold at another financial institution, contact that financial institution immediately.

If you suspect fraud on an account you hold at another financial institution, contact that financial institution immediately.

'Missed' Jury Duty Scam

What Are 'Missed' Jury Duty Scams?

Jury duty scams are seeing a resurgence with scammers preying on fears of arrest, penalties, and other legal troubles. Jury duty scams have been long-running schemes, but as always, awareness is the best defense against these persistent attempts to steal your money or personal information.

How to spot a jury duty scam

Victims of a jury duty scam will receive a phone call, text or email from a scammer impersonating a law enforcement officer or court official claiming the victim hasn't shown up for their allotted jury service and must pay a fine as a result. The scammers also tend to ask for personal information.

Signs of a jury duty scam

- Threatening language: Scammers will try to create a sense of anxiety in victims.

- Phishing tactics: Email scams will attempt to appear legitimate but keep an eye out for fake email addresses and spelling mistakes.

- Clickable links: These will take you to phishing sites asking you to provide sensitive personal and financial information.

- Payment options: Scammers will request funds to be transferred by crypto, gift cards, wire transfer, or instant payment apps like Zelle, Venmo, or Cash App. No court, police department, or government agency will ask for payment over the phone for 'missed' jury duty.

- Request for information: Scammers may ask for personal information like Social Security details or demand for funds to be sent.

How to Stay Safe

- Never click through an unsolicited email or text.

- Never divulge sensitive personal and financial information online or over the phone.

- Never pay alleged fines by gift cards, crypto or money transfers.

- Use anti-malware on all devices and computers to help filter out phishing messages and emails.

If you have received a call, email, or text regarding 'missed' jury duty and believe you have paid a false fine, please contact us at customer.service@unibank.com or call us at 800.578.4270.

Debit Card Collection Scam

What is a Debit Card Collection Scam?

There have been new reports of scammers posing as banks texting and calling victims about "Fraudulent Activity" on their accounts. During the follow up phone call, scammers have been notifying victims that the bank will be sending someone to the victim's home to collect their debit card and there have been situations where a scammer has physically collected a victim's card from their home.

UniBank will NEVER send someone to your home to retrieve your debit card. If someone shows up at your house claiming to be from your bank, do not give them anything and call the police right away.

If you receive any requests to change your id and/or password, hang-up and contact us at customer.service@unibank.com or call us at 800.578.4270.

Links & Resources